Table of Contents

- What the heck is Due Diligence in commercial real estate, really?

- Why due diligence saves you (sometimes even from yourself)

- The key phases of due diligence (the real ones, not the textbook version)

- Common mistakes I’ve seen (and you can avoid)

- Final reflection

Let me say it exactly as it comes to mind: talking about Due Diligence in commercial real estate doesn’t sound, at first glance, like the sexiest topic on earth. But nope… once you understand what it really involves, you realize it’s basically like reading a property’s secret diary. And trust me, there are always surprises in there.

Let me tell you something: the first time I participated as an observer in a real estate transaction (yes, one of those where everyone wears suits and nobody smiles), I saw how a single line in a contract almost ruined a million-euro deal. One. Line. That’s when I understood that due diligence is not some boring checklist — it’s survival.

And you? Have you ever had that “Why did no one tell me this earlier?” feeling?

Well, get ready, because this article might just change the way you look at buildings.

What the heck is Due Diligence in commercial real estate, really?

A deep dive into the property (yes, even the uncomfortable parts)

Let me make it simple: due diligence is that moment when, before dropping a single euro, you decide to lift every stone in the building — even if there’s dust, spiders, or unpaid invoices from five years ago hiding underneath.

It’s like when you fall in love with an apartment and suddenly discover the humidity has more history than you do.

With commercial properties, the same thing happens… but multiply it by a hundred.

A solid review looks at:

- The real physical condition (not the cute photos the seller chose).

- The numbers — not the fairy tales the seller tells.

- The environmental risks nobody mentions but end up costing a fortune.

- And those legal details that, if you blink, turn into nightmares like “You just inherited the previous owner’s lawsuit.”

Is all that work worth it? Yes. Always.

Why due diligence saves you (sometimes even from yourself)

That weird mix of intuition and legal paperwork

Okay, personal confession: I’m the kind of person who can fall in love with a place because of the lighting, the smell of coffee, or the echo in a hallway. But commercial real estate doesn’t work like that. You can’t buy a warehouse just because it “feels right.”

Due Diligence in commercial real estate forces you to pause, breathe, and look at things like a responsible investor — even if your heart is screaming something different.

And yes, there’s something emotional wrapped in all this. The fear of making a mistake. The excitement of finding “the hidden gem.” The stress of the numbers.

Tell me — do you ever wish for a clear sign?

Well, due diligence is that sign.

The key phases of due diligence (the real ones, not the textbook version)

1. Looking under the rug

Literally. And figuratively.

Because under the rug you can find anything from cracks to forgotten documents tied to old debts.

2. Reading the documents nobody wants to read

This is where you uncover things like:

- Tenants who seemed profitable… but aren’t.

- Clauses that turn a “promising investment” into a financial black hole.

- Permits that were “supposedly included,” but surprise: they weren’t.

Ever trusted something just because “it looks fine”?

That instinct can cost thousands here.

3. Running the numbers… and then running them again

Commercial properties live or die by their cash flow.

If the math doesn’t add up, emotions won’t save you.

4. Thinking about the future (even if you hate long-term planning)

Because maybe today everything works perfectly, but…

- What if a tenant leaves?

- What if taxes go up?

- What if the area changes?

Due diligence is the art of imagining the worst-case scenario without having a meltdown.

Common mistakes I’ve seen (and you can avoid)

Mistake #1 — Believing what you’re told without confirming

We all do it, even the “experienced” ones.

But hey… why not verify?

H3: Mistake #2 — Not talking to the tenants

They’ll tell you things the seller would never mention.

H3: Mistake #3 — Doing due diligence too late

Once you’re “in love” with the property, your objectivity goes on vacation.

H2: Is all this effort worth it?

Yes.

Absolutely yes.

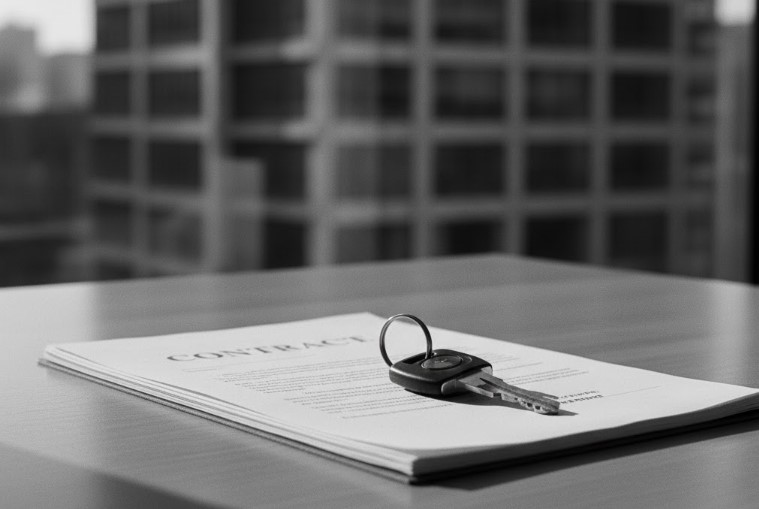

Due Diligence in commercial real estate is the difference between buying a profitable asset… or adopting someone else’s problem wrapped with a cute red bow.

And in the end, this process teaches you to see properties as they truly are — not as they’re painted for you. Kind of like going from a heavily edited photo to seeing someone in real life with zero filters.

Final reflection

Let me leave you with a question I always ask when I help someone with an investment:

Do you prefer discovering the problems before buying… or after, when there’s no turning back?

If your answer is “before,” then congratulations — you’re already a due diligence fan, even if you didn’t know it.