Table of Contents

- What Does ROI Really Mean in Commercial Real Estate?

- Step 1: Calculating Your Real Investment

- Step 2: NOI — Your Net Operating Income

- Step 3: Key Factors That Influence Your ROI

- Step 4: Common Mistakes That Destroy ROI

- Step 5: Strategies to Maximize Your ROI

- Step 6: Final Reflection

If you’ve ever wondered whether buying a commercial property is actually a good idea, let me tell you something: you’re not alone. I’ve had my fair share of sleepless nights thinking, “Am I about to put my money in the right place, or am I walking straight into a disaster?”

That’s why today I want to talk to you about the evaluation of the return on investment (ROI) of commercial properties—and not in some cold, technical way, but the way a friend would explain it after getting burned a couple of times and learning the hard lessons.

This isn’t just about numbers and formulas; it’s about understanding how your investment can affect your life, your goals, and your peace of mind. So let’s break it all down—step by step—with real examples, common mistakes (yes, the ones we’ve all made), and a little bit of brutally honest insight.

What Does ROI Really Mean in Commercial Real Estate?

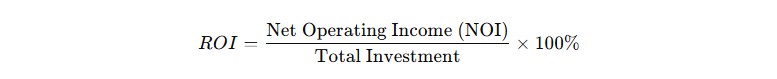

When you hear ROI, you might think: “Oh, just another boring formula.” But no. It’s actually your compass in an ocean full of opportunities… and a few financial sharks.

ROI tells you how much you’re earning compared to everything you put on the table: purchase price, improvements, legal fees—everything.

Sounds fancy, right? But in practice it might look like this: you buy a property for $1,000,000, spend $100,000 on renovations, and after subtracting taxes, maintenance, and insurance, your annual net income is $88,000. Your ROI is around 8%.

Not bad. But the real question is: Is 8% worth the effort and risk?

Step 1: Calculating Your Real Investment

A common mistake—one I personally learned the hard way—is thinking the purchase price is the whole investment. Spoiler alert: it’s not. Your total investment includes:

- Purchase price

- Closing and legal costs

- Initial repairs and improvements

- And all those unexpected extras that somehow always appear

I still remember the first property I analyzed. I thought $500,000 was the total. Wrong. After renovations and paperwork, I ended up investing nearly $650,000. A painful but necessary wake-up call: always calculate everything upfront.

Step 2: NOI — Your Net Operating Income

NOI is the heart of ROI. It’s your income minus operating expenses. That includes:

- Rent

- Additional income (parking, ads, kiosks…)

- Minus taxes, insurance, utilities, maintenance

My personal advice? Always run a conservative scenario. Imagine two months of vacancy or a random repair popping up. That way your ROI doesn’t look perfect on paper and disastrous in reality.

Cap Rate or ROI?

Some investors compare properties using the cap rate, which is basically ROI without counting your full investment—just the market value. It’s great for quick comparisons, but don’t forget: cap rate alone doesn’t tell the whole story.

Step 3: Key Factors That Influence Your ROI

If you think this is just crunching numbers, think again. The ROI of a commercial property also has an emotional and human side—location, demand, tenant behavior. Here are the big ones:

- Location: cliché, yes, but completely true.

- Condition of the property: tenants avoid outdated, poorly maintained spaces.

- Tenant type and leases: reliable, long-term tenants = stable cash flow.

- Operating expenses: underestimate them and your ROI collapses.

- Market trends: e-commerce, demographics, new infrastructure—they all matter.

Once, I was analyzing a seemingly perfect retail space. Everything aligned… until a new highway changed the traffic flow. The property lost visibility and the projected ROI evaporated. Moral of the story: don’t just look at numbers—look at context.

Step 4: Common Mistakes That Destroy ROI

- Ignoring hidden costs

- Assuming zero vacancy

- Overestimating rental demand

- Forgetting about obsolescence

- Believing that ROI alone is enough to judge an investment

I’ve been guilty of all of these at some point. That’s why evaluating ROI honestly means being realistic—even if it hurts a little.

Step 5: Strategies to Maximize Your ROI

Now the fun part: how to make your investment truly worth it.

- Negotiate good financing terms

- Invest in improvements that actually increase income

- Choose quality tenants (your mental health will thank you)

- Think ahead about resale value

- Stay updated with market trends

And one more thing: trust your gut. Yes, investing is numbers… but it’s also intuition. If something feels off, pause before signing anything.

A Real Example From My Own Experience

I once bought a small office building. Projected ROI: 10%. I was thrilled. But I forgot to include a $20,000 electrical upgrade. Suddenly the ROI dropped to 8.5%. Not the end of the world, but a perfect reminder that projected ROI is never final.

Step 6: Final Reflection

The evaluation of the return on investment (ROI) of commercial properties is not just math. It’s risks, people, neighborhoods, timing, and possibilities. Ask yourself:

- Is this investment truly worth it?

- Am I prepared for surprises?

- How does this property fit into my long-term story?

A good ROI isn’t just a number—it’s peace of mind.

Your Next Investment

Before signing any deal: calculate the full investment, estimate NOI, run your ROI, and prepare conservative scenarios. Remember: a good ROI doesn’t guarantee success, but a bad evaluation almost guarantees regrets.

Here is an interesting guide on: Step-by-Step Guide to Evaluating ROI in Commercial Properties