Table of Contents

- Why Multifamily Analysis Is More Than Just Numbers

- The Real Starting Point: The Market

- Key Factors That Truly Matter (and Some That Don’t)

- The Fun Part: Valuation and Metrics

- Realistic Projections: The Art of “What If…”

- The Side No One Tells You: Emotional Due Diligence

- Technical Due Diligence

- Value-Add Strategies That Truly Transform a Business

- Real Risks (and How to Face Them Without Fear)

- Final Reflection

When someone asks me how to analyze investment opportunities in multifamily housing, I always feel that behind that question there’s something deeper: they’re not just looking for numbers—they’re looking for clarity, safety, and the feeling that they’re making a smart decision for their future. I get it. I went through the same thing once—doubts, mistakes, gut feelings I didn’t know whether to trust… and that strong desire to find “the perfect deal.”

Today I want to share with you a more human, practical, and realistic approach to analyzing these opportunities. Not just cold techniques, but a way of thinking that helps you see what others miss.

Why Multifamily Analysis Is More Than Just Numbers

I’m going to say something that might sound strange: most people analyze multifamily deals poorly because they get trapped in Excel. And yes, the numbers matter. A lot. But a spreadsheet won’t show you the smell of moisture in the stairwell, the type of tenants, or the vibe—yes, the vibe—of the area.

Before calculating the cap rate, ask yourself:

- Do I like this market?

- Would I live near here?

- How does it feel to walk down this block?

- What energy does the property give off?

Sometimes just one street over, the deal changes completely.

The Real Starting Point: The Market

Understand the Context Before the Numbers

This is where the magic begins. And yes, this is also where the process of how to analyze investment opportunities in multifamily housing truly begins… although many new investors skip this step (and pay dearly for it).

The Question That Changes Everything

Where are people moving?

If the population is growing, if new jobs are emerging, if you see cranes, new coffee shops, malls being renovated… believe me, something is happening there.

A Small Personal Example

A few years ago, I analyzed a multifamily property in a small town. The numbers looked beautiful: 9% cap rate, low expenses, solid NOI. But something bothered me. A little knot in my stomach.

I decided to visit the area.

Saturday at 3 pm, downtown was… empty. Almost apocalyptic.

Later I learned the largest employer had just announced layoffs.

Conclusion?

As a veteran investor once told me:

“If demand isn’t growing, your cash flow will eventually suffer.”

That deal never tempted me again.

Key Factors That Truly Matter (and Some That Don’t)

Location: Yes… but Not the Way They Sell It

It’s not just “good area vs bad area.”

I prefer asking:

- Is there economic mobility?

- Is the area improving or declining?

- What do the locals say, not the travel blogs?

Go See It Yourself

Have a coffee at a local bakery. Watch people. Listen.

The market will speak to you… but only if you listen without rushing.

Income Potential

Here we do look at numbers, but gently—not obsessively.

- Compare current rents vs market rents.

- Evaluate neighborhood vacancy.

- Identify whether there’s a value-add opportunity.

Mini-Example

A building has units rented at $850

The area supports $1,050

Light renovation: $4,000 per unit

Is the investment worth it?

It depends, of course… but those extra $200 per unit can change everything.

Unit Mix

Here lie opportunities few people notice.

A building with 70% one-bedroom units and 30% two-bedrooms behaves very differently from one inverted: 70% two-bedrooms and 30% studios.

Why?

Because tenant stability changes drastically.

And that, dear reader, is pure gold.

The Fun Part: Valuation and Metrics

NOI, the True Heart of the Building

Net Operating Income isn’t glamorous, but without it, you’re buying blind.

Gross income

Minus operating expenses

Minus estimated vacancy

= Realistic NOI (the keyword here is realistic, not “optimistic seller version”).

Common Mistake

Many beginners subtract only the expenses “seen on the list.”

Huge mistake.

Include:

- Capital reserves

- Future repairs

- Insurance increases

- Inflation on services

If your analysis ignores these factors, your NOI will be an illusion.

Cap Rate: Useful but Incomplete

Sure, everyone talks about it.

But cap rate is just a snapshot of the present.

I use it to understand the property’s current story, not its future.

Here’s a powerful question:

Is the cap rate aligned with the real risk, or is there a disconnect?

When there’s a disconnect, there’s usually opportunity… or disaster (depending on your ability to read between the lines).

Realistic Projections: The Art of “What If…”

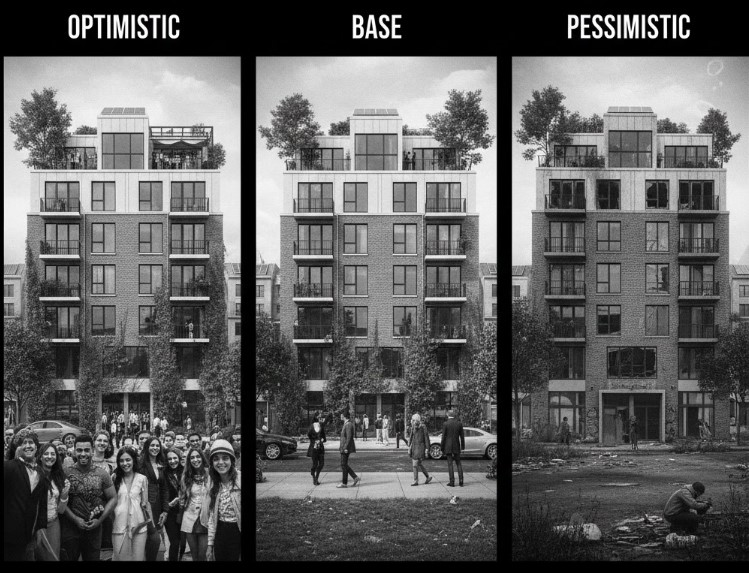

Build Scenarios (Not One, but Three)

- Optimistic

- Base

- Pessimistic

And then ask yourself:

Do I still want the building even in the pessimistic scenario?

If the answer is no, walk away.

Don’t hesitate.

Intuition is a valid tool here.

The Side No One Tells You: Emotional Due Diligence

Yes, emotional. Because analyzing multifamily deals also stirs up fears:

- What if I’m wrong?

- What if expenses are higher?

- What if I try hard and it still doesn’t work?

I know. It’s normal.

I once rejected an incredible deal simply because emotionally I wasn’t ready to manage a 32-unit building in another city. And I’m glad I did. I learned that the best multifamily isn’t the most profitable—it’s the one you can manage without your life turning into chaos.

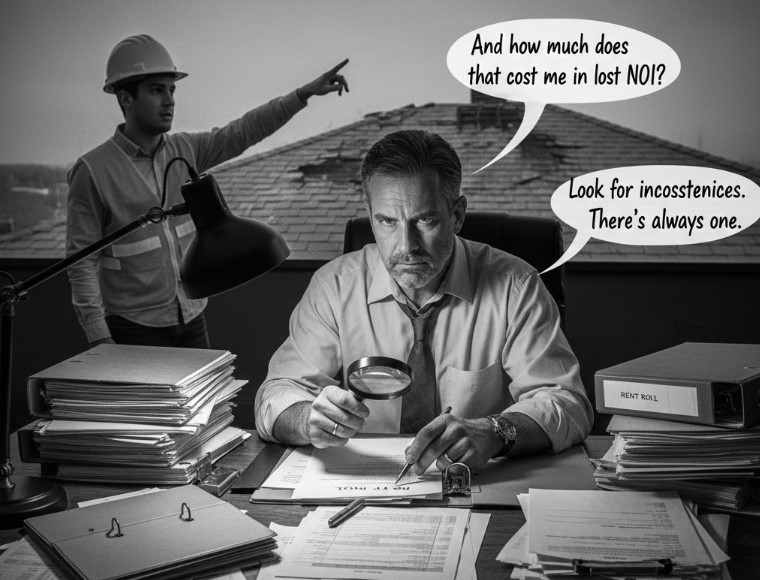

Technical Due Diligence

Review Documents Like a Detective

- Rent rolls

- Bank statements

- Invoices

- Maintenance contracts

- Taxes

- Capex history

Look for inconsistencies.

There’s always one.

Physical Inspection

The inspector might say “roof deteriorated.”

But you should ask:

And how much does that cost me in lost NOI?

Not all expenses affect profitability the same way.

Value-Add Strategies That Truly Transform a Business

Strategic Rent Increases

I’m not talking about increasing rent just because.

I’m talking about increasing with purpose.

New Income Streams

- Parking

- Pets

- Storage

- Laundry

- RUBS (if applicable)

Sometimes an extra $25 multiplied by 24 units… is pure magic.

Real Risks (and How to Face Them Without Fear)

Let’s keep it real:

- Unexpected vacancy

- Insurance increases

- Major repairs

- Market downturns

- Poor management

But let me tell you something:

With solid analysis, a cool head, and a steady heart, multifamily properties can be one of the noblest investments out there.

Final Reflection

If you’ve made it this far, you’re already better prepared than 80% of people who jump into investing without truly knowing how to analyze investment opportunities in multifamily housing.

This path requires technique, yes.

But it also requires intuition, sensitivity, and the ability to see what others don’t.

So tell me…

Are you ready to analyze your next multifamily with new eyes?