If you’re trying to understand multifamily revenue management, let me tell you something right away: you’re not alone. Everyone working in the industry —or orbiting around it— has faced that moment of staring at occupancy numbers, prices, competition… and feeling like we’re playing chess on a board that changes every five minutes.

And yes, I know the term sounds technical. But the truth is that behind it lies a very simple idea: how to help a multifamily building earn more… without falling into improvisations, blind intuition, or decisions that come back to bite us later.

Let me tell you why this actually matters.

What the heck is multifamily revenue management, really?

(Yes, let’s say it in human words.)

In short, it’s a system —a way of thinking, working, and deciding— that blends data, dynamic pricing, analysis, and some good old common sense to help a multifamily property reach optimal revenue.

But here’s the interesting part: it’s not just about raising rents.

In fact, that would be a terrible strategy.

Multifamily revenue management focuses on adjusting prices intelligently:

- according to demand,

- according to seasonality,

- according to competition,

- according to unit type,

- and according to the exact timing of the market.

It’s almost like tuning a guitar: you don’t crank every string to the max. You adjust each one, with intention, so the whole thing sounds right.

Why everyone is talking about this now

Let’s be honest: the multifamily world has changed a lot.

Before, you could set a price, print the sheet, put it in a folder and you were done. Not anymore.

Today, supply moves. Demand moves too. Renters compare everything— from the price to the direction of the afternoon balcony shadow — and owners want to squeeze every dollar with fewer guess-and-hope tactics.

And that’s where multifamily revenue management steps in like a kind of “financial GPS.”

It doesn’t decide for you, but it shows you the smartest path.

I saw it myself a few years ago: an operator insisted on keeping prices the same because “it had always worked.” The result?

The property was full, yes, but at terribly low rents. It was like running a restaurant with every table occupied and still losing money.

Once they implemented a revenue management strategy, they didn’t just boost revenue — they finally understood the true value of each unit. And wow, does that change the game.

Benefits that actually matter (not the ones on software brochures)

I’m going to speak without filters here.

1. Higher revenue, but without “biting” the customer

The key isn’t to charge more — it’s to charge better.

Multifamily revenue management adjusts pricing so the market accepts it, without resorting to desperate discounting.

2. Healthier occupancy

Ever ended up with vacant units for months because of a mispriced listing?

The system helps prevent exactly that.

You’re not chasing the market — you’re one step ahead.

3. Data-based decisions (not gut feelings)

Nothing against intuition — we all use it.

But when talking about rents, a messy spreadsheet or an “I think that…” can cost thousands.

An RMS brings clarity where shadows used to be.

4. A more aligned team

When everyone has their own theory of the “right price”… things get messy.

With a multifamily revenue management strategy, everyone speaks the same language.

How everything works behind the scenes

(Let’s go backstage for a moment.)

If we open the box, we’ll see that a good multifamily revenue system mixes several components:

Dynamic pricing

There isn’t one eternal price.

There’s a price per unit, per type, per day, per level of demand.

Smart forecasting

A model capable of predicting how many units will move next month, how many renewals are coming, and how seasonality behaves.

Renewal management

Here lies one of the hidden treasures.

A huge portion of revenue doesn’t come from new leases… but from retaining current residents effectively.

Competitor analysis

Let’s be honest: everyone checks the neighbor’s prices.

An RMS does it for you, without opening 20 browser tabs.

Dashboards that actually help

Good systems don’t overwhelm; they show what you truly need to decide.

The challenges no one talks about (but they’re real)

This all sounds great, but let me share some truths:

Forecasting is hard

Even the most advanced models miss the mark when a black swan shows up (pandemics, crises, strikes… you know).

Not every team embraces change

Some operators feel “a machine isn’t going to tell me how to set prices.”

And yes, that resistance is real.

Units are NOT all the same

A fifth-floor unit facing the park does not have the same value as a first-floor unit facing the parking lot, even if they’re both 600 sq ft.

Regulations

In rent-controlled markets, flexibility becomes a puzzle.

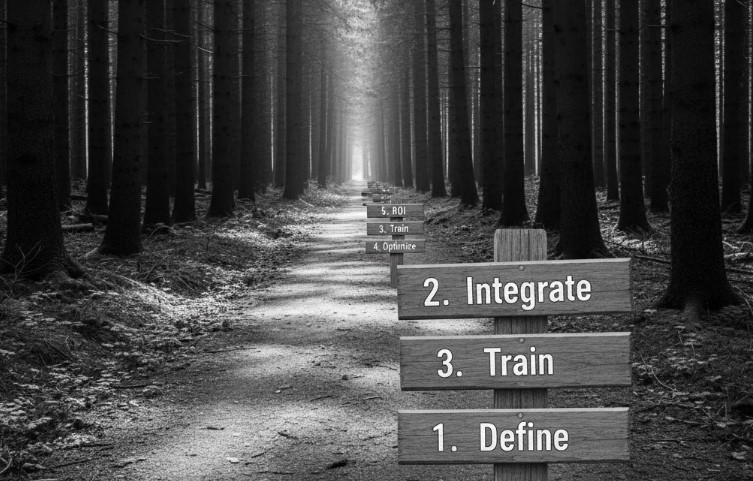

How to get started without losing your mind

If right now you’re thinking: “Okay… but how do I apply all this without going crazy?”

Here are simple steps:

1. Define what you want

More revenue? Less vacancy? Better retention?

2. Integrate your RMS with your current software

Magic happens when everything connects.

3. Train your team

Nothing kills a system faster than a team that doesn’t understand it.

4. Audit pricing regularly

An RMS isn’t 100% automatic.

Supervision matters.

5. Measure ROI

A change without measurement is useless.

Want a quick story?

(Promise it’s short.)

I met a manager once who said:

“Adjusting prices is like cooking rice. If you stir too much, it gets mushy. If you leave it alone, it burns.”

I laughed at the time, but now I see she was right.

Multifamily revenue management helps you “move just enough”: intervene precisely to improve revenue, without compulsive daily adjustments.

Her property went from 94% occupancy to 97%, and revenue per unit rose by more than 8% a year.

It wasn’t magic. It was consistency.

7 top multifamily revenue management

1. RealPage – AI Revenue Management

RealPage offers one of the most established revenue management systems in the multifamily industry. Their AI-driven platform forecasts demand, balances occupancy with pricing, and typically outperforms market averages by 2–5%.

Website: https://www.realpage.com

2. Yardi – Revenue IQ

Yardi Revenue IQ automatically adjusts pricing for new leases and renewals using real-time data, demand forecasting, and portfolio-level insights. It integrates directly with Yardi Voyager for end-to-end property management.

Website: https://www.yardi.com/product/revenue-iq

3. REBA Rent

REBA focuses on “total cost of occupancy” to deliver more realistic pricing recommendations for multifamily. It’s designed to handle concessions, rent regulations, and complex market dynamics with transparency.

Website: https://www.getreba.com

4. Spherexx – Optimize Revenue Management

Spherexx uses neural intelligence to forecast pricing opportunities and optimize strategies across your portfolio. Their system emphasizes flexible workflows and strong analytics visualizations.

Website: https://www.spherexx.com

5. RentVision – Revenue Management

RentVision predicts future supply and demand based primarily on your property’s own marketing and leasing trends. Its pricing recommendations are transparent and don’t rely heavily on third-party data.

Website: https://www.rentvision.com

6. Entrata – Pricing / Revenue Management

Entrata’s pricing engine uses multiple variables—market data, inventory, traffic, and more—to generate optimal rent recommendations. It integrates seamlessly into Entrata’s unified property management ecosystem.

Website: https://www.entrata.com

7. Vena Solutions

While not a traditional revenue management system, Vena provides advanced budgeting, forecasting, and performance management tools. Multifamily operators use it to model pricing, lease-level projections, and long-term financial planning.

Website: https://www.vena.io

Final question for you

If tomorrow you had to review the pricing of your units, would you do it with data or with intuition?

This isn’t a theoretical question.

It’s the one that determines whether you keep reacting… or start leading.

Unlock New Revenue Streams in Multi-Family Properties

What Is the Apartment Revenue Stream? Before I overload you with strategies, let’s be clear:The…

Apartment Resident Retention Ideas: The Straightforward Guide

Have you ever felt that, no matter how hard you try, your tenants leave as…

Rent optimization or revenue optimization?

If you work in real estate — or you’re simply curious about how rental prices…